A new study by dappGambl has analysed the current state of the NFT market to reveal how many NFTs are now considered “dead”.

In recent years, NFTs have been the stars of the crypto world, seeing monthly trading volume peak at $2.8 billion in August 2021. However, NFTs are now in the midst of a bare market, seeing searches for “Are NFTs Dead” skyrocket by 114% in the past year.

By analysing over 73,000 NFTs listed on NFTScan, as well as the top 8,000 NFTs listed on CoinMarketCap, dappGambl can conclude how many NFTS have a market cap and floor price of $0 as well as how many collections have been left unsold and are now classed as “redundant”.

Only 5% Of NFTs Have A Market Cap Above $0

Of the 73,257 NFT collections identified on NFTScan, an eye-watering 69,795 of them have a market cap of 0 Ethereum. This means, 95% of the current NFT market is now considered worthless, leaving only 5% of the market holding any type of value.

Also, of the collections identified, only 21% had 100%+ ownership, meaning that 79% of all NFT collections (4 out of 5) have remained unsold.

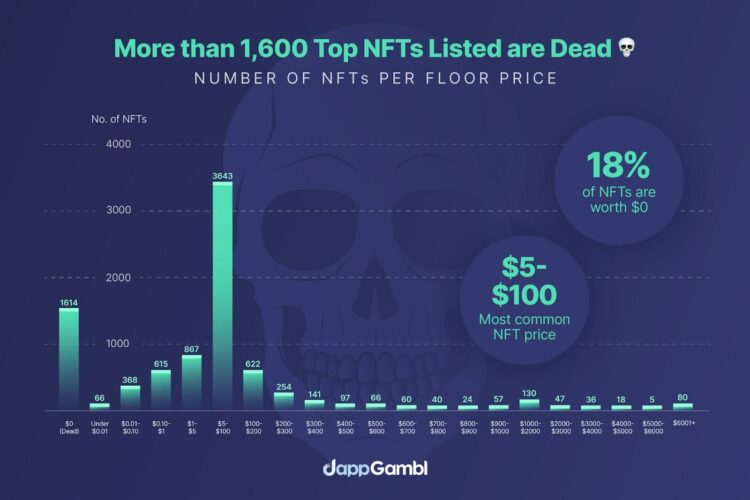

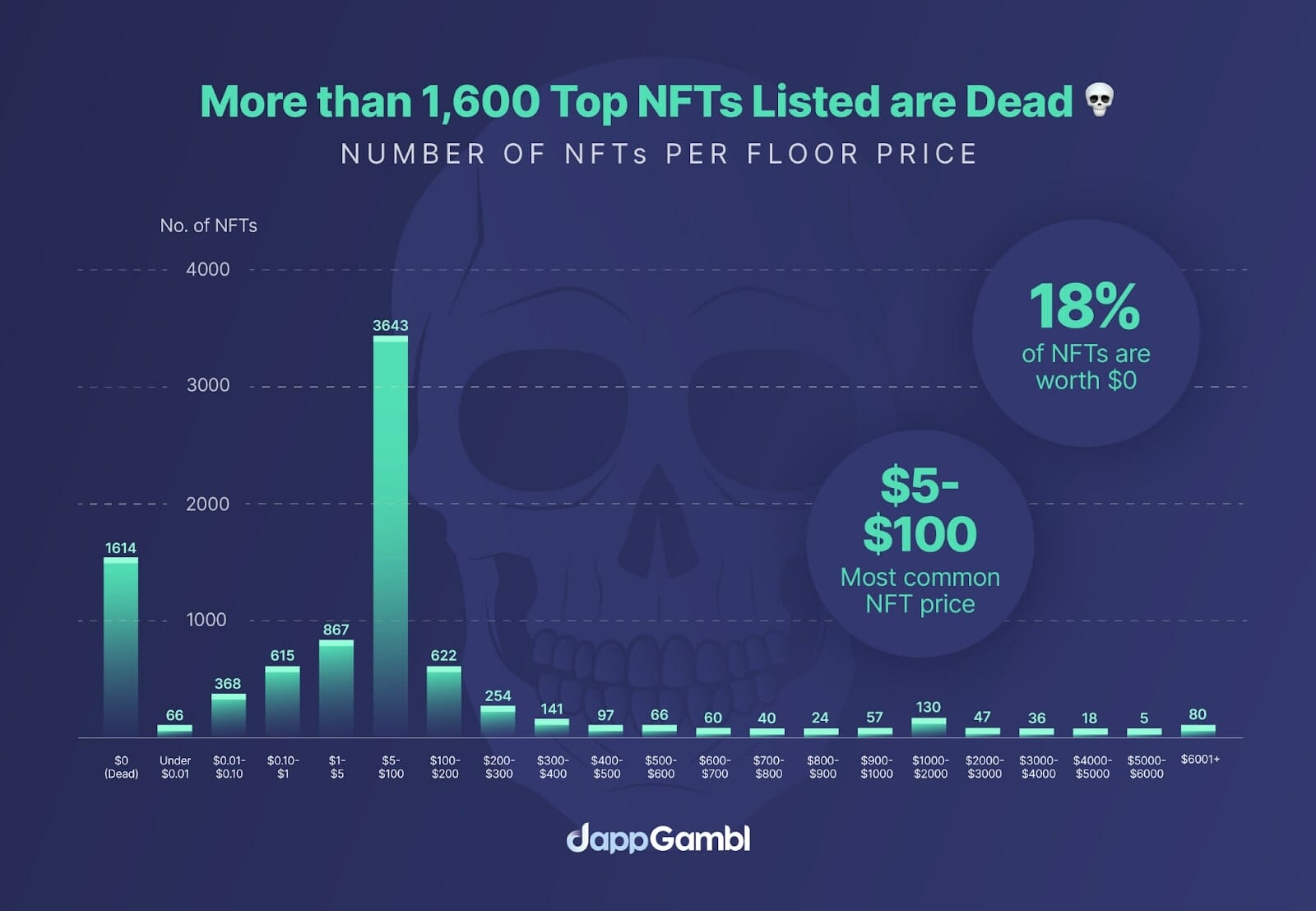

18% of Top NFTS Have A Floor Price Of $0 And Are Considered “DEAD”

The NFT market is full of many “dud” investments, so to analyse the market fairly dappGambl also analysed the top 8850 collections on CoinMarketCap to get a better snapshot of the market.

In the top NFT market, 18% of collections have a floor price of zero indicating that a significant portion of even the most prominent collections are struggling to maintain demand.

The study also showed that the majority of NFTs are valued between $5-$100 – making up 41% of the market whilst less than 1% of these NFTs boast a price tag of over $6,000.

*It’s important to note that more collections are also likely considered “dead” than stated above as many valued themselves in the millions despite seeing all-time sales at less than $20. This discrepancy between listed floor prices and actual sales exposes inflated valuations that don’t reflect genuine buyer interest or real-world transactions whereby they can also be considered ‘dead’.

Do you know which under-the-radar stocks the top hedge funds and institutional investors are investing in right now? Click here to find out.

Experts Believe NFTs Have A Future But They Need Real Use Cases

Vlad Hategan, expert at dappGambl comments on the future of NFTs:

“The recent analysis of the NFT market, conducted by our team, revealed that 79% of all NFT collections have remained unsold whilst 95% of NFTs have a market cap of $0 ETH. This is the daunting reality that despite the euphoria often surrounding the NFT space, potential buyers and investors are now looking to buy into more than collectables which only served as a ‘flex’, like Bored Ape Yacht Club, but NFTs with clear use cases, compelling narratives, or genuine artistic value.

“As the market matures, NFTs are likely to pivot from mere collectables to assets with tangible utility and significance to help them weather market downturns. Examples of these use cases are already beginning to evolve, seeing NFTs which help preserve cultural heritage, create usable in-game purchases as well as venture into the real estate industry – holding more long-term value than the majority of the current NFT market.”

About dappGambl:

dappGambl are a group of blockchain and casino enthusiasts that consider crypto casinos and other gambling dApps to be the future of online gambling. Their mission is to provide gamblers with all the information, guides and knowledge they need to start playing in their first blockchain casino and start profiting from the many advantages.